Meet our Team of Certified Financial Counselors

Our team of Financial Counselors have been trained through the Credit Union National Association's Financial Counseling Certification Program (FiCEP). FiCEP provides credit union employees with the skills and knowledge required to guide members like you to sound financial decisions. Our certified Financial Counselors can help you:

- Understand how to create a budget you can stick with.

- Receive guidance on the best ways to repair, rebuild, and maintain a strong credit score and history.

- Discuss options to begin saving and evaluate savings goals.

- And more!

Christy Lockman

Broken Arrow North

(1105 East Albany Street)

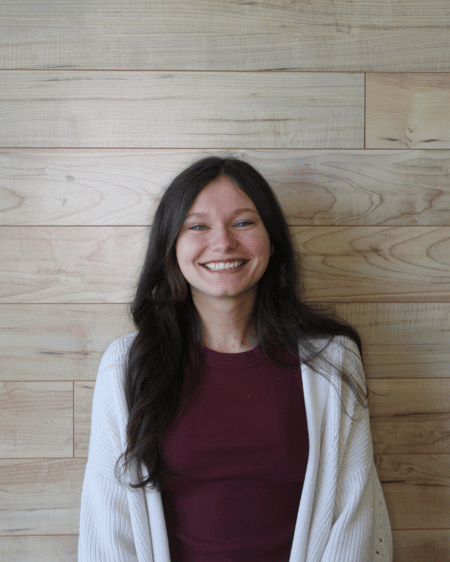

Zoe Flatt

Broken Arrow North

(1105 East Albany Street)

Mandi Harrell

Broken Arrow South

(2211 South Aspen Avenue)

Andrea Hogan

Broken Arrow South

(2211 South Aspen Avenue)

Jade McCracken

Broken Arrow South

(2211 South Aspen Avenue)

Tony Smith

Brookside

(4956 South Peoria Avenue)

Daniel Quinones

Brookside

(4956 South Peoria Avenue)

Sal Paredes*

Centennial Park

(515 South Peoria Avenue)

Cara Casement

Centennial Park

(515 South Peoria Avenue)

Gary Cornett

Garnett

(11335 East 41st Street)

Mackenzie Holcomb

Garnett

(11335 East 41st Street)

Ashley Schuh

Garnett

(11335 East 41st Street)

Abel Medina

Jenks Landing

(11408 S Union Ave)

Dena Keith

Owasso

(12901 East 116th Street N)

Rebekah Branch

Sheridan South

(6728 East 81st Street South)

Krislynn Foster

Sheridan South

(6728 East 81st Street South)

EJ Wilson

Tulsa Hills

(8075 South Olympia Ave)

Patti Banks

Tulsa Hills

(8075 South Olympia Avenue West)

*Bilingual counselor: English and Spanish / Consejero es bilingüe: Inglés y español